Want our Plan?

Click here to learn how!

| Online enrollment for the CalPERS 457 Plan has been enhanced to include Roth after-tax contributions

The online enrollment experience for the CalPERS 457 Plan has been enhanced to include saving for retirement on a pre-tax and/or Roth after-tax basis (if your agency can process Roth contributions from their payroll). The CalPERS 457 Plan materials on the Employer Resource Center have been updated to help guide and educate you and your employees. New online enrollment materials have also been created to answer Frequently Asked Questions and help you access enrollment information in both myCalPERS and Sponsor Web. While enrollment forms from the Participant Enrollment Kit will continue to be accepted, we encourage you implement online enrollment as soon as administratively feasible.

|

|

Cost of Living Adjustments — On November 1, 2024, the Internal Revenue Service issued Notice 2024-80 to announce the 2025 dollar limits.

The Roth Option — CalPERS has added the Roth option for all agencies that have adopted the CalPERS 457 Plan.

Plan Document — The CalPERS 457 Deferred Compensation Plan Document has been updated for 2023.

Intranet Page — Add this helpful template of CalPERS 457 Plan links and resources to your intranet site.

Employer Guide (2021): Easy-to-follow steps for 457 Plan payroll submissions

Add Roth to a Payroll Report — After adopting Roth for your Plan, follow these steps for myCalPERS reporting.

The CalPERS 457 Plan partners with Voya to provide full services to our agencies and their employees. Learn more about where to get support for you and your employees.

You can call the CalPERS 457 Employer Plan Line at 800-696-3907 for email calpers_457_plan@calpers.ca.gov for general contribution and payroll support.

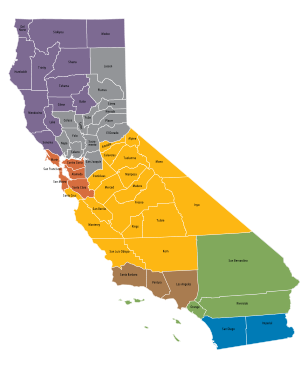

Your agency’s dedicated Account Manager is available for presentations and appointments (both online and in person) with your employees to help with their CalPERS 457 Plan accounts. Call 888-713-8244 or visit to schedule an appointment.

Your employees can get help with their CalPERS 457 Plan accounts by visiting calpers457.com or calling the Plan Information Line at 800-260-0659.

Sponsor Web is a website designed for plan sponsors that allows you to view participant and plan level information at any time. You can request access to this site by contacting us today.

| Employer Cents Newsletter |

| Making Cents Newsletter |

| myOrangeMoney |

| Helpful Links and Forms Library |

| CalPERS Perspective Newsletter |

|

Employee Enrollment Kit (06/27/2025)

Employee Enrollment Kit (06/27/2025)

CalPERS 457 Plan representatives are available to assist you.

CalPERS 457 Plan representatives are available to assist you.