|

The CalPERS 457 Plan’s Self-Managed Account

now offers even more investment choices

When it comes to investing, people have different levels of risk tolerance and experience making investment-related decisions. Some don’t have the experience or knowledge to develop and manage an investment portfolio. Others prefer to select and actively manage their own mix of investments. Schwab Personal Choice Retirement Account® (PCRA) is a self-managed account option in the CalPERS 457 Plan that is suitable for knowledgeable investors who understand the risks associated with many of the investment choices available through PCRA and seek to complement their core investments in the Plan.

The enhanced PCRA provides participants with greater access to investments. That includes more than 8,700 no-load mutual funds from over 600 well-known fund families, including over 2,700 funds typically available only to institutional clients. It includes over 3,800 mutual funds with no-loads and no-transaction fees1. Other investments also include individual stocks from all the major exchanges, bonds and other fixed income investments, CDs, and money market funds. Please note, however, that the investments available through PCRA are not selected, reviewed, or monitored by CalPERS.

CalPERS 457 Plan participants will be notified about the additional investment options that are now available through PCRA. For your eligible non-participating employees, though, we encourage you to use this enhancement as another way to help promote enrollment and participation in the CalPERS 457 Plan. You and your employees can learn more by reviewing the Self-Managed Account Overview. Your dedicated Account Manager1 can also help educate your employees about their saving and investing options on the journey to and through retirement. Call 888-713-8244 today to discuss ways your Account Manager can provide retirement education to your employees.

1 For participants who utilize the Personal Choice Retirement Account (PCRA), the following fees and conditions may apply:

Trades in no-load mutual funds available through Mutual Funds OneSource service (including Schwab Funds) as well as certain other funds, are available without transaction fees when placed through schwab.com or our automated phone channels. Schwab reserves the right to change the funds we make available without transaction fees and to reinstate fees on any funds. Funds are also subject to management fees and expenses. Charles Schwab & Co., Inc., member SIPC, receives remuneration from fund companies for record keeping, shareholder services and other administrative services for shares purchased through its Mutual Fund OneSource service. Schwab also may receive remuneration from transaction fee fund companies for certain administrative services.

2 Information from registered Plan Service Representatives is for educational purposes only and is not legal, tax or investment advice. Local Plan Service Representatives are registered representatives of Voya Financial Advisors, Inc. (member SIPC).

Schwab Personal Choice Retirement Account (PCRA) is offered through Charles Schwab & Co., Inc. (Member SIPC), the registered broker/dealer, which also provides other brokerage and custody services to its customers. ©2025 Charles Schwab & Co., Inc. All rights reserved. Used with permission. Charles Schwab and Voya are separate and unaffiliated and are not responsible for each other’s policies or services.

It is vital to let the CalPERS 457 Plan team know when there are changes to your personnel. Let’s work together to ensure that we have updated records of your agency’s points of contact, their roles, and how to reach them by phone and email. Please report any changes to the CalPERS 457 Plan team as soon as possible by contacting:

|

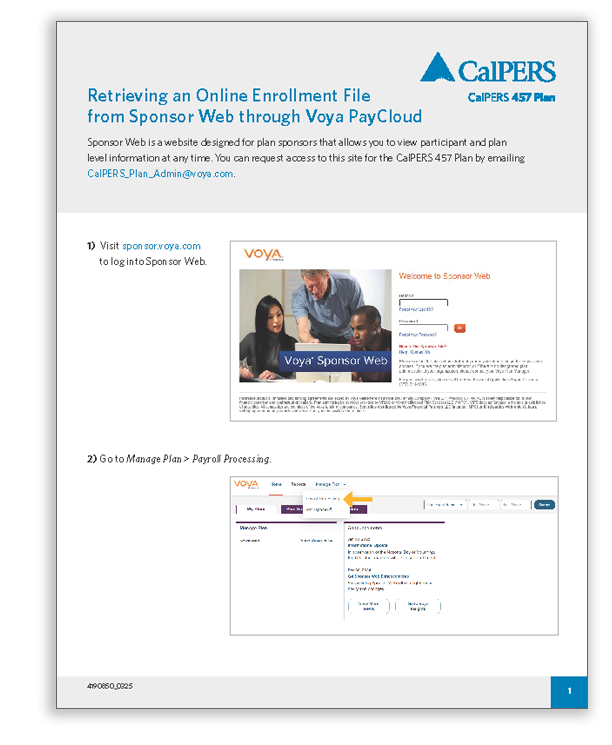

The CalPERS 457 Plan’s Self-Managed Account now offers even more investment choices Confirm your FICA status with CalPERS Help your employees focus on their finances and future during America Saves Week Get online enrollment reports for the CalPERS 457 Plan through Sponsor Web View the updated schedule of live CalPERS 457 Plan webinars and on-demand videos Schedule a CalPERS 457 Plan review to help satisfy your fiduciary responsibility

|

CalPERS Employer Resource Center making cents Participant Newsletter Schedule a Personal Phone Appointment

|