Plan Document — The CalPERS 457 Deferred Compensation Plan Document has been updated for 2025.

Cost of Living Adjustments — On November 13, 2025, the Internal Revenue Service issued Notice 2025-67 to announce the 2026 dollar limits.

Navigating the SECURE 2.0 Act — Learn how CalPERS has adopted the mandatory and some optional provisions through the SECURE 2.0 Act as it applies to the CalPERS 457 Plan.

Intranet Page — Add this helpful template of CalPERS 457 Plan links and resources to your intranet site. |

The CalPERS 457 Plan partners with Voya to provide full services to our agencies and their employees. Learn more about where to get support for you and your employees.

You can call the CalPERS 457 Employer Plan Line at 800-696-3907 for email calpers_457_plan@calpers.ca.gov for general contribution and payroll support.

Your employees can get help with their CalPERS 457 Plan accounts by visiting calpers457.com or calling the Plan Information Line at 800-260-0659.

Sponsor Web is a website designed for plan sponsors that allows you to view participant and plan level information at any time. You can request access to this site by contacting us today. |

|

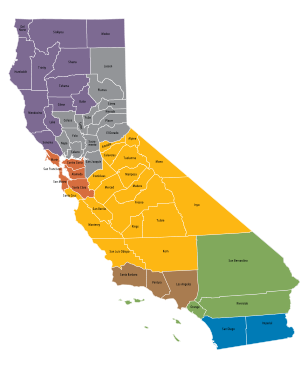

| Schedule a one-on-one personal phone appointment with your dedicated Account Manager today. |

Click here to learn how Click here to learn how |

Schedule an appointment today Schedule an appointment today |

| |

|

|

CalPERS 457 Plan representatives are available to assist you.

CalPERS 457 Plan representatives are available to assist you.