Important 2022 year-end payroll reporting reminder

Please make sure that the payroll contributions your payroll team submits between late December 2022 and early January 2023 are applied for the correct tax year to your participants’ CalPERS 457 Plan account. Here’s how to ensure accuracy and avoid posting delays during the 2022 year-end payroll reporting period:

- Work closely with Voya Financial®, who handles recordkeeping administration for the CalPERS 457 Plan.

- If the pay end date for the last payroll of 2022 is not the same tax year as your pay date (for example — your pay end date for the last payroll of the year is December 31, 2022, but your employees will not receive their checks for this payroll period until after January 1, 2023), It is imperative that you send Voya an email at CalPERS_Plan_Admin@voya.com. Please include your agency name and number (45****) in the email subject line.

Please submit payrolls that apply to different tax years on different days in myCalPERS. For example — if reporting the last payroll for 2022 and first for 2023, please report 2022 first and then report 2023 the following business day.

Changes to the CalPERS 457 Plan

The CalPERS Board of Administration recently approved changes to the CalPERS 457 Plan based on changing characteristics of Plan participants and financial market conditions. The following changes were made effective October 1, 2022.

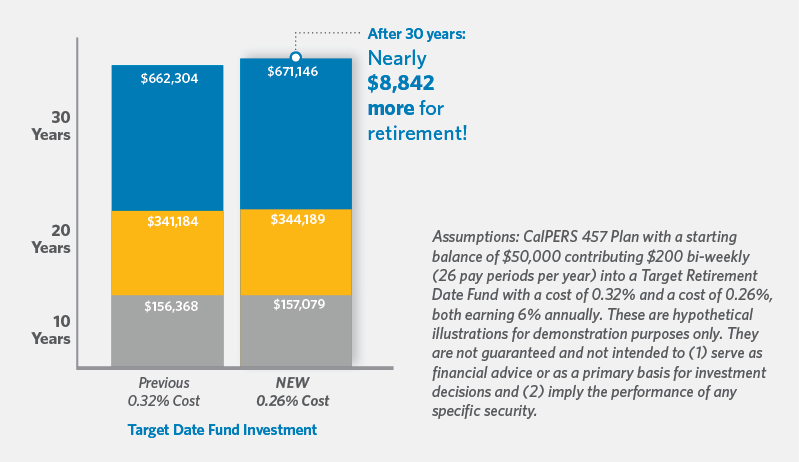

Fees reduced for all 457 Plan investment options

The costs associated with the Core and Target Retirement Date Funds were reduced by 0.06% in the CalPERS 457 Plan effective October 1. The costs were reduced to a range between 0.25% - 0.38%, depending on the investment, down from a range between 0.31% – 0.44%. The cost reductions allow all 457 Plan participants to keep more of their investment dollars working in their account, helping to accumulate more savings over time. Read the Fee Reduction Notice that was sent to CalPERS 457 Plan participants in October for more information.

We hope you will encourage all employees to consider enrolling in the CalPERS 457 Plan as a way for them to reach their retirement goals through voluntary savings. The new reduced cost will help your employees keep more invested dollars in their account, which could mean thousands more in retirement compared to the previous Plan costs.

It is vital to let CalPERS know when there are changes to your team. Let’s work together to ensure that we have updated records of your agency’s points of contact, their roles, and how to reach them by phone and email. Please report any changes to team members as soon as possible by contacting:

|

Important 2022 year-end payroll reporting reminder Changes to the CalPERS 457 Plan Fillable CalPERS 457 Plan forms are now available Reminder — New CalPERS 457 Plan resources are now available Schedule a CalPERS 457 Plan presentation for employees, led by your dedicated Account Manager Request a plan review to help satisfy your fiduciary responsibility

|

CalPERS Employer Resource Center making cents Participant Newsletter Schedule a Personal Phone Appointment

|

For more information about the Plan, your employees should visit calpers457.com or contact your agency’s dedicated Account Manager at 888-713-8244.

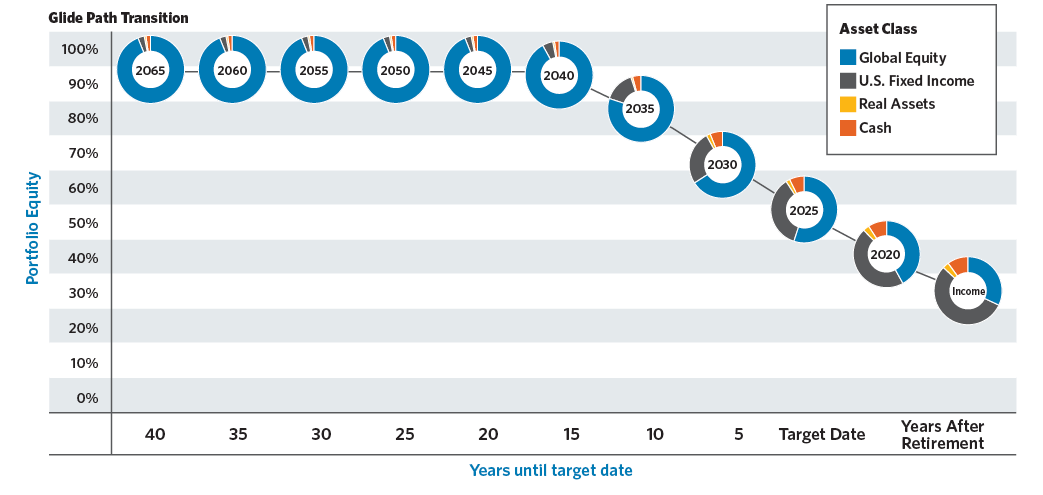

Changes to the Target Retirement Date Funds

Each Target Retirement Date Fund’s mix of stocks, bonds, real assets and cash changed effective October 1 based on factors such as a review of participant demographics, life expectancy, estimated salary growth, and changing market conditions. Each fund’s updated glide path and new asset allocation is depicted in the graphic below.

Read the Target Date Fund Change Notice that was sent to CalPERS 457 Plan participants in September for more information.