The SIP Remittance Advice Report is Important

It is vital that you complete and send the CalPERS Supplemental Income Plans (SIP) Remittance Advice Report with your CalPERS 457 Plan contribution check payments.

The report contains remittance advice information specific to the CalPERS 457 Plan, including the total receivable amount being paid and the check number associated with the payment.

Sending a completed SIP Remittance Advice Report with check payments ensures the timely deposit of CalPERS 457 Plan contributions made by participants.

Please keep in mind:

- The SIP Remittance Advice Report is different from the Remittance Advice Report used for the CalPERS Pension and Health Benefits.

- 457 Plan payments are different from other CalPERS program payments.

For this reason, the Plan prefers to receive CalPERS 457 Plan check payments separately from other CalPERS programs to reduce the potential for confusion. If this is not possible, the Plan may be able to accommodate your request to send all check payments together.

A CalPERS Supplemental Income Plans (SIP) analyst will contact your agency soon about how to access and use the SIP Remittance Advice Report.

The SIP Remittance Advice Report is available in the Cognos section of my|CalPERS.

Regional my|CalPERS training is available for employers who wish to learn more about how to access and generate reports, including navigating through the reports application in my|CalPERS.

For CalPERS 457 Plan my|CalPERS assistance, email us or call 1-800-696-3907, Monday – Friday, 8:00 a.m. to 5:00 p.m. (Pacific Time).

For assistance not related to the CalPERS 457 Plan, call 1-888-CalPERS (or 1-888-225-7377), Monday – Friday, 8:00 a.m. to 5:00 p.m. (Pacific Time).

As the Plan fiduciary, CalPERS Supplemental Income Plans reviews the CalPERS 457 Deferred Compensation Plan document periodically. Under the Employer Adoption Agreement, CalPERS retains the authority to amend the Plan document from time to time.

During the most recent review, amendments were made to the Plan document to reflect recent changes in Internal Revenue Code and defined-contribution plan best practices. Some of the most recent changes include:

Default Investment Option Feature: Upon initial enrollment in the Plan, participants’ contributions will be invested in the Plan’s designated “default option” (currently CalPERS Target Date Retirement funds*). Participants may reallocate or change their deferrals and account balance within the available investment options at any time. Limitations may apply to investing in the Plan or the Self-Managed Account.

Updated Deferral Limits: Both Standard and “Catch Up” contribution limits have been updated to reflect current amounts permitted by the Internal Revenue Service (IRS).

Updated Self-Managed Account (SMA) Provisions: The terms and conditions for participation in CalPERS Self-Managed Account (SMA) option have been clarified.

Updated Beneficiary Designation Provisions: Terms and conditions regarding beneficiary designations have been updated and clarified.

Investments in Target Date Funds are subject to the risks of their underlying funds. The year in the Fund name refers to the approximate year (the target date) when an investor in the Fund would retire and leave the work force. The Fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. An investment in a Target Date Fund is not guaranteed at any time, including on or after the target date.

The amended Plan document is available under Employer Materials in the Employer Resource Center at www.calpers-sip.com.

We encourage you to review the entire amended Plan document.

The 15th annual |

Sign up for CalPERS Employer Educational Forum

We’re bringing the CalPERS Educational Forum back to Southern California this year! Don’t miss the premier CalPERS event in Riverside October 27–29, 2014. The 15th annual Forum includes new sessions and two powerful keynote speakers. As always, there will be exhibits, leadership training and networking time during this three-day event.

The Forum is your opportunity to meet representatives from all areas of CalPERS and access their in-depth knowledge, extensive experience, visions and lessons.

New for this year is a Sunday session with various health plans. You will have the opportunity to learn more about each plan and take advantage of one-on-one sessions with plan representatives. Attendees will also be able to register on Sunday!

Also back by popular demand is the Social Media Café, with electronic device charging stations.

Register soon! The fee is $350 and includes all of the above, in addition to breakfast and lunch Monday through Wednesday, and the Board of Administration Welcome Reception.

You can find Forum registration information on CalPERS On-Line at www.calpers.ca.gov. Also new this year is our registration process. We have a new system that will allow you register online and create a personalized schedule for the conference. Be green and please register online.

See you in Riverside October 27–29.

New Name for ING: Voya Financial™

ING, the record keeper for the CalPERS Supplemental Income Plans, is changing its name to Voya Financial. Nothing changes to participant accounts or the quality retirement services they receive as a result of this name change. In September, Voya will appear on account statements, printed materials and the participant plan website, and by the end of 2014, on all other materials.

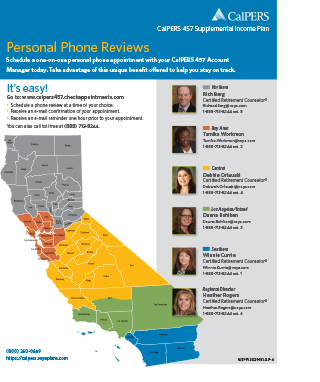

Please remind your employees that experienced local representatives

are available to talk with them on Phone Review Fridays.

They can go online to www.ingforcalpers457sip.checkappointments.com and:

• Schedule a phone review at the time of their choice.

• Receive an e-mail confirmation of the appointment.

• Receive an e-mail reminder one hour prior to the appointment.

• Use the link to cancel the appointment if necessary.

CalPERS Supplemental Income 457 Plan representatives are available to assist you.

For CalPERS 457 Plan my|CalPERS assistance, email us or call 1-800-696-3907, Monday – Friday, 8:00 a.m. to 5:00 p.m. (Pacific Time).

To schedule onsite participant appointments or presentations, we encourage you to call your local Plan representative toll free, 1-888-713-8244 Monday – Friday, 8:00 a.m. – 5:00 p.m. (Pacific Time).