Year-End Payroll Reporting

To make sure the payroll contributions you submitted between late December 2015 and early January 2016 are applied for the correct tax year to your participants’ CalPERS Supplemental Income 457 Plan accounts, please work closely with Voya Institutional Plan Services, LLC, the company that handles Plan recordkeeping administration.

Here are two ways you can help your agency ensure accuracy during this year-end payroll reporting period:

- Send an e-mail to CalPERS_Plan_Admin@voya.com if the pay end date for the last payroll of 2015 is not the same tax year as your pay date. Please include your agency name and number in the e-mail subject line.

[Example: your pay end date for the last payroll of the year is December 28, 2015 but your employees will not receive their checks for this payroll period until after January 1, 2016.]

There is no need to contact Voya if the pay end date of your payroll period is in the same tax year as the pay date for the period.

- Send a fax to 1-888-228-6185 if your agency’s contact person(s) or address changed.

Contribution Limits The Same In 2016

Please remind all Plan participants that the Internal Revenue Service (IRS) did not change the limits on contributions to the 457 Plan in 2016.

| Maximum Annual Contribution | $18,000 |

| Maximum including Age 50+ Catch-Up | $24,000 |

| Maximum including Three-Year Special 457(b) Catch-Up |

Up to $36,000 |

Make sure your employees who are close to retiring know that they could save more for retirement by making a catch-up contribution to the Plan if they are at least age 50, or if eligible, using the Three-Year Special 457(b) Catch-Up.

To use the Age 50+ Catch-Up, a Participant Change Authorization Form should be completed and submitted it to your Benefits Office.

Please work closely with your employees who may be eligible for the Three-Year Special 457(b) Catch-Up. If a participant is within three years of the year in which that individual will reach the Plan’s definition of normal retirement age, the participant will need to:

- calculate the available amount under the Three-Year Special 457(b) Catch-Up in 2016 based on the participant’s prior contributions

- complete a Participant Change Authorization Form and Three-Year Special 457(b) Catch-Up Worksheet and return both to you.

Participants who want to increase their current deferrals to the Plan under one of these catch-ups must complete the Participant Change Authorization Form before the first day of the calendar month in which the compensation would be paid or made available.

IRS rules provide that both catch-up options cannot be used in the same tax year. Participants who are eligible for both can use the catch-up option that allows them to contribute the greatest amount in that tax year.

Does your agency still mail paper checks to CalPERS for Supplemental Income 457 Plan contributions and other receivables?

Consider switching to Electronic Funds Transfer (EFT) payments in the new year. EFT is a method of instructing financial institutions to electronically transfer money from one account to another, eliminating the use of paper checks.

By using EFT for CalPERS payments, your agency has a lot to gain:

- reduced manual paperwork and greater accuracy

- save money: no more check printing and postage expenses

- no missed payment deadlines

- improved cash management

You have full control of the release of funds. CalPERS does not have access to your bank account without your authorization. You also have plenty of flexibility:

- your choice of two electronic payment options, including the debit method offered free online through my|CalPERS

- make single or multiple payments at a time

- modify or cancel EFT payments

- transfer online payment history to an Excel document for reconciliation and accounting reports

For more information or help with setting up EFT payments, call the CalPERS Supplemental Income 457 Plan toll free 1-800-696-3907.

Faster Self-Service, New Look

Faster Self-Service, New Look For Employer Resource Center

The Employer Resource Center at calpers-sip.com has been newly redesigned. Clean graphics and simpler navigation will help you see and find what you need quickly. The items you come back for most often — enrollment kits, forms, participant and employer materials – are right up top to save you time. Check it out soon!

The first required annual withdrawal from the CalPERS Supplemental Income 457 Plan, called a Required Minimum Distribution (RMD), must be taken by April 1 of the year following the year in which participants reach age 70½, or in the year they retire, whichever is later. A 50% IRS penalty tax applies on the RMD amount not taken by the deadline. |

Please encourage your agency’s employees who have not yet enrolled to participate in the CalPERS Supplemental Income 457 Plan Benefits & Basics webinar on Friday, March 4, 2016 at 12 p.m. (Pacific Time).

This webinar explains the benefits of Plan participation, contribution limits, the investment options and how the pre-tax savings program supplements the CalPERS pension.

Employees may register online at

https://attendee.gotowebinar.com/register/2509362981218212098

or www.gotowebinar.com (Webinar ID 119-218-315).

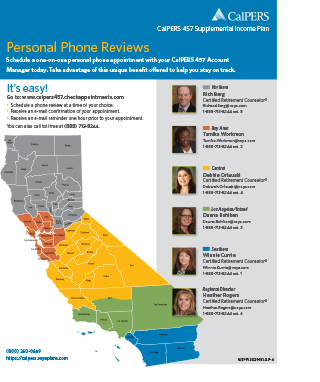

Your employees can get answers and help from experienced licensed representatives. When they use www.calpers457.checkappointments.com to set an appointment, they will receive a confirmation and reminder by e-mail. Or they can call toll free 1-888-713-8244 weekdays 8 a.m. – 5 p.m. (Pacific Time).

CalPERS Supplemental Income 457 Plan representatives are available to assist you.

For CalPERS 457 Plan my|CalPERS assistance, email us or call 1-800-696-3907, Monday – Friday, 8:00 a.m. to 5:00 p.m. (Pacific Time).

To schedule onsite participant appointments or presentations, we encourage you to call your local Plan representative toll free, 1-888-713-8244 Monday – Friday, 8:00 a.m. – 5:00 p.m. (Pacific Time).