Survey Deadline Is Now February 16

CalPERS and Voya Institutional Plan Services, LLC want to hear from as many participants in the CalPERS Supplemental Income 457 Plan as possible. The deadline for completing a short participant satisfaction survey has been extended to February 16, 2015.

CalPERS and Voya Institutional Plan Services, LLC want to hear from as many participants in the CalPERS Supplemental Income 457 Plan as possible. The deadline for completing a short participant satisfaction survey has been extended to February 16, 2015.

The survey offers a convenient way to share feedback about this optional benefit. All responses will be completely confidential.

Please continue your efforts to help make this survey a success:

- Make 457 Plan participants in your department aware of the survey.

- Between now and February 16, send them timely reminders with the survey link.

- Those who prefer a paper survey can call (720) 484-4633 to request one.

- If you haven’t already done so, complete the survey if you are participating in the 457 Plan.

When the survey results are ready, we will share them with you. Thanks so much for your support.

Introducing myOrangeMoney™ and

Your Personal Financial Dashboard

CalPERS Supplemental Income 457 Plan accounts have been enhanced with two new online interactive tools: myOrangeMoney™ and your Personal Financial Dashboard.

myOrangeMoney helps Plan participants focus on how their account balances translate into estimated monthly income in retirement. They can see their progress toward their retirement readiness every time they log in.

Your Personal Financial Dashboard is a convenient tool for organizing all financial accounts and priorities in one place. The information is encrypted using advanced security features and updates automatically, providing a complete financial picture.

For videos with details, click myOrangeMoney and your Personal Financial Dashboard.

CalPERS Featured In The Journal of Retirement

“Increasing Defined Contribution Plan Participation: A California Pilot Project,” an article by Jon D. Kanemasu, Stacie Sormano Walker and Valerie Wong, appeared in the Fall 2014 issue of the Journal of Retirement.

The article reports the results of different outreach strategies used by three State of California agencies in a pilot program to increase enrollment and existing enrollee contributions to the CalPERS Supplemental Income 457 Plan.

The Journal of Retirement is written by leading practitioners and academics and read by finance industry professionals. Published quarterly by Institutional Investor, Inc., the Journal provides analyses and insights that translate into actionable ideas.

The 457 Basics Webinar On March 5

Please encourage employees who have not yet enrolled in the CalPERS Supplemental Income 457 Plan to join the 457 Basics webinar on Thursday, March 5, 2015 at 12 p.m. (Pacific Time).

This webinar explains how to enroll, the Plan’s investment choices, account management, and distributions, and presents demonstrations of myOrangeMoney and your Personal Financial Dashboard.

It’s simple to register at https://attendee.gotowebinar.com/register/519277713089081089 or www.gotowebinar.com (Webinar ID 106-749-267).

Please remind all Plan participants that the Internal Revenue Service (IRS) raised the limits on contributions to the 457 Plan in 2015. |

|

|

Higher Contribution Limits In 2015

| Maximum Annual Contribution | $18,000 |

| Maximum including Age 50+ Catch-Up | $24,000 |

| Maximum including Three-Year Special 457(b) Catch-Up | Up to $36,000 |

Make sure your employees who are close to retiring know that they could save more for retirement by making a catch-up contribution to the Plan if they are at least age 50 or eligible for the Three-Year Special 457(b) Catch-Up.

To use the Age 50+ Catch-Up, a Participant Change Authorization Form should be completed and submitted to your Benefits Office.

Please work closely with your employees who are within three years of the year in which they will reach the Plan’s definition of normal retirement age to calculate the Three-Year Special 457(b) Catch-Up amount available to them in 2015 based on their prior contributions. They will need to complete a Participant Change Authorization Form and Three-Year Special 457(b) Catch-Up Worksheet and return both to you.

IRS rules provide that both catch-up options cannot be used in the same tax year. Participants who are eligible for both can use the catch-up option that allows them to contribute the greatest amount.

Required Minimum Distributions

The first required annual withdrawal from the CalPERS Supplemental Income 457 Plan, called a Required Minimum Distribution (RMD), must be taken by April 1 of the year following the year in which participants reach age 70½, or in the year they retire, whichever is later. A 50% IRS penalty tax applies on the RMD amount not taken by the deadline.

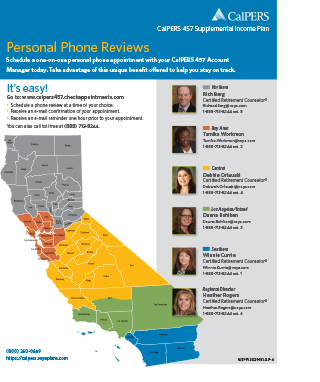

Your employees can get answers and help from experienced licensed representatives on Phone Review Fridays or any day that’s best for them.

By using www.CalPERS457.checkappointments.com to set an appointment, they will

receive a confirmation and reminder by e-mail. Or they can call toll free (888) 713-8244

weekdays 8 a.m. – 5 p.m. (Pacific Time).

CalPERS Supplemental Income 457 Plan representatives are available to assist you.

For CalPERS 457 Plan my|CalPERS assistance, email us or call 1-800-696-3907, Monday – Friday, 8:00 a.m. to 5:00 p.m. (Pacific Time).

To schedule onsite participant appointments or presentations, we encourage you to call your local Plan representative toll free, 1-888-713-8244 Monday – Friday, 8:00 a.m. – 5:00 p.m. (Pacific Time).